All Categories

Featured

Table of Contents

For those ready to take a little bit extra risk, variable annuities offer added opportunities to expand your retirement assets and possibly increase your retired life income. Variable annuities provide a variety of investment alternatives supervised by specialist cash supervisors. Therefore, financiers have much more adaptability, and can also relocate possessions from one alternative to an additional without paying tax obligations on any investment gains.

* An immediate annuity will certainly not have a build-up phase. Variable annuities released by Protective Life Insurance Company (PLICO) Nashville, TN, in all states other than New York and in New York by Safety Life & Annuity Insurance Policy Company (PLAIC), Birmingham, AL.

Capitalists ought to carefully take into consideration the investment purposes, dangers, charges and costs of a variable annuity and the underlying financial investment options before investing. This and other details is included in the syllabus for a variable annuity and its underlying financial investment options. Programs might be gotten by speaking to PLICO at 800.265.1545. An indexed annuity is not a financial investment in an index, is not a protection or securities market financial investment and does not participate in any supply or equity financial investments.

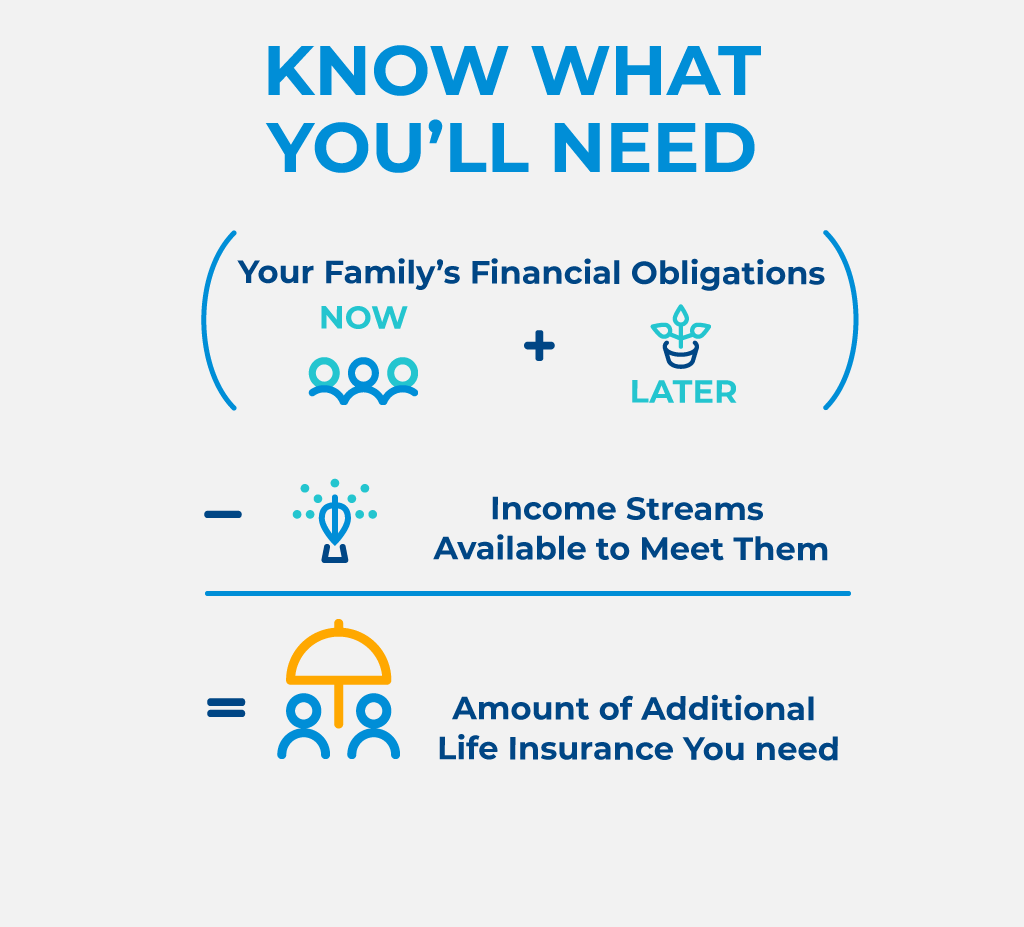

What's the distinction between life insurance policy and annuities? It's a common inquiry. If you question what it requires to secure a financial future on your own and those you like, it might be one you find on your own asking. And that's a really great point. The lower line: life insurance policy can assist supply your enjoyed ones with the financial comfort they should have if you were to die.

How do I receive payments from an Annuity Contracts?

Both need to be considered as component of a long-lasting economic strategy. When contrasting life insurance and annuities, the most significant difference is that life insurance is created to assist safeguard against a financial loss for others after your death.

If you want to learn much more life insurance policy, checked out the specifics of how life insurance policy functions. Think about an annuity as a tool that might help meet your retired life requirements. The primary objective of annuities is to develop earnings for you, and this can be done in a few various methods.

Flexible Premium Annuities

There are several possible advantages of annuities. Some include: The capability to grow account worth on a tax-deferred basis The capacity for a future revenue stream that can not be outlived The opportunity of a round figure benefit that can be paid to an enduring spouse You can buy an annuity by providing your insurance business either a solitary round figure or paying over time.

People typically acquire annuities to have a retired life earnings or to develop cost savings for another function. You can get an annuity from a certified life insurance agent, insurance policy business, monetary coordinator, or broker. You ought to speak to a monetary advisor concerning your requirements and objectives prior to you purchase an annuity.

How much does an Lifetime Payout Annuities pay annually?

The difference in between the two is when annuity settlements begin. You don't have to pay taxes on your earnings, or payments if your annuity is a specific retirement account (INDIVIDUAL RETIREMENT ACCOUNT), till you take out the earnings.

Deferred and prompt annuities supply several choices you can pick from. The options supply different levels of possible threat and return: are assured to make a minimal interest rate.

Variable annuities are higher risk since there's an opportunity you could shed some or all of your cash. Set annuities aren't as high-risk as variable annuities because the investment threat is with the insurance policy firm, not you.

If efficiency is low, the insurance provider births the loss. Fixed annuities ensure a minimal rates of interest, generally between 1% and 3%. The firm might pay a greater interest price than the ensured rate of interest price. The insurer figures out the rates of interest, which can change monthly, quarterly, semiannually, or yearly.

Who provides the most reliable Annuities options?

Index-linked annuities show gains or losses based on returns in indexes. Index-linked annuities are more intricate than taken care of deferred annuities (Lifetime payout annuities).

Each depends on the index term, which is when the company calculates the rate of interest and credit histories it to your annuity. The figures out exactly how much of the boost in the index will certainly be utilized to determine the index-linked passion. Various other vital features of indexed annuities include: Some annuities cap the index-linked rate of interest.

The floor is the minimum index-linked rate of interest rate you will gain. Not all annuities have a flooring. All repaired annuities have a minimal surefire value. Annuity payout options. Some business utilize the standard of an index's worth instead of the worth of the index on a specified date. The index averaging might take place any time during the term of the annuity.

How do I apply for an Annuity Income?

The index-linked interest is contributed to your original premium quantity but does not substance during the term. Various other annuities pay compound interest during a term. Compound passion is passion made on the money you conserved and the passion you make. This suggests that passion already attributed likewise gains passion. The rate of interest made in one term is normally worsened in the following.

If you take out all your cash prior to the end of the term, some annuities will not attribute the index-linked rate of interest. Some annuities might credit only component of the passion.

Where can I buy affordable Variable Annuities?

This is because you birth the financial investment risk instead of the insurance provider. Your representative or financial consultant can assist you make a decision whether a variable annuity is right for you. The Securities and Exchange Payment classifies variable annuities as safety and securities due to the fact that the efficiency is originated from supplies, bonds, and various other investments.

Find out more: Retired life ahead? Consider your insurance coverage. An annuity agreement has two phases: a buildup phase and a payout phase. Your annuity makes interest during the buildup phase. You have several choices on just how you add to an annuity, relying on the annuity you purchase: enable you to choose the moment and amount of the payment.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options Everything You Need to Know About What Is Variable Annuity Vs Fixed Annuity What Is the Best Retirement Option? Features of Variable Annuities Vs Fixed Annui

Exploring Immediate Fixed Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works What Is Fixed Annuity Vs Variable Annuity? Benefits of Pros And Cons Of Fixed Annuity And Variable

Understanding Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Deferred Annui

More

Latest Posts